Statement

Zakat, the financial lever of the community

In the name of God, the Most Gracious, the Most Merciful

In accordance with the directives of the Caliph, this report aims to remind us of the importance of zakat, a fundamental pillar of Islam, and to clarify the collection methods. Seydina Limamou Lahi (Pbuh) stated:

“Keep your wealth for yourselves and come share mine.”

He also said:

“I ask you to give me God’s share from the wealth that He has placed in your hands” (zakat).

Zakat, the financial lever of the community

The Caliph reminds that the community today needs regular, structured, and transparent financial support more than ever. Zakat represents this essential source of funding. It belongs to God (SWT) and should be regarded as a spiritual and collective duty. While some disciples are already committed in this dynamic, others are still slow to invest in it. This message is intended as a fraternal recall to the entire community.

The disciples living in the following localities are particularly expected to promote this dynamic:

- Dakar and surroundings: Yoff, Camberène, Yeumbeul, Malika, Thiaroye, Pikine, Teungueuthie, Bargny, Ngor, Ouakam, Niacoulrab, Yarakh, Jandeer, and others districts of the capital.

- Others regions: Thiès (such as Ngakham, Keur Thième Sawaré and surroundings), Diourbel, Fatick, Kaffrine, Kédougou, Kaolack, Kolda, Louga, Matam, Saint-Louis, Sédhiou, Ziguinchor, Tambacounda.

- In localities with a representative of the Caliph: he is responsible for coordinating the monthly collection. The funds must be sent to the Caliph or credited into a dedicated bank account (information to come), along with proof of payment and a list of donors.

- In locations without a representative : the imams take charge of the collection, following the same rules.

- In areas without a representative or imam, disciples are encouraged to approach neighboring locations with a functional organization.

The Caliph also makes a solemn appeal to the disciples living abroad, notably in:

- North America: United States, Canada

- Europe: France, Italy, Spain, Germany, Portugal, United Kingdom, Luxembourg

- Africa: Ivory Coast, Morocco, South Africa, Gabon, etc.

- South America: Brazil, Argentina, etc.

- Asia and the Middle East: China, Japan, Saudi Arabia, Qatar

- Oceania: Australia

Each group is invited to organize itself with its dahiras and local coordinators to ensure a regular collection and payment, in a spirit of rigor and transparency.

- For financial income: 2.5% (i.e., 25 per 1000)

The payments must start from August, thus allowing time for localities to organize themselves effectively.

The Caliph focusses on the need to build a financially autonomous community, independent from the State and external aid. This relies entirely on well-organized and regularly paid zakat.

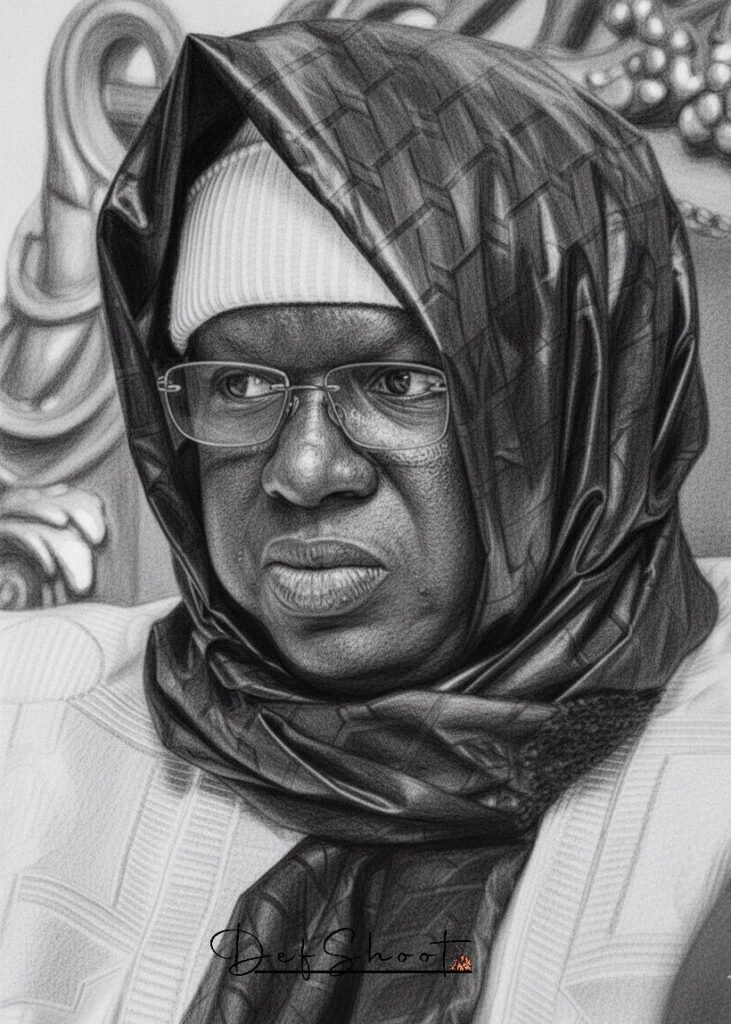

The Caliph, accompanied by his brother Seydi Mame Libasse, in charge of zakat, will conduct regular assessment of the implementation in each district.

The Caliph is receptive to any sincere proposal aimed at improving this process and strengthening community commitment.

A specific bank account will be communicated shortly to facilitate payments.

The Caliph invites all disciples, wherever they are, to respond to this call with faith, sincerity, responsibility, and commitment.

May God accept our efforts, purify our intentions, and strengthen our unity.

May peace and blessings be upon the prophet, his family, and his companions. Amen

📊 Zakat Calculator

Calculate your Zakat according to Islamic principles - 2.5% of your annual savings

Calculate Your Zakat

Your Zakat Due

Amount entered: $0

Zakat rate: 2.5% (Quarter of one-tenth)

Method used: 2.5%

Calculation formula:

Amount × 0.025 = Zakat

💡 About Zakat

What is Zakat?

Zakat is the third pillar of Islam. It is a compulsory charity that every Muslim must pay when they possess a certain amount of wealth (Nisab) for a full lunar year.

Zakat Rate

The Zakat rate on money is 2.5% (one-quarter of one-tenth). This rate applies to savings, investments, and cash held for one year.

Nisab (Minimum Threshold)

Nisab is the minimum amount of wealth above which Zakat becomes obligatory. It is equivalent to 85 grams of gold or 595 grams of silver according to Islamic jurisprudence schools.

Beneficiaries

Zakat is intended for the poor, the needy, those in debt, stranded travelers, and other categories mentioned in the Quran (Surah At-Tawba, verse 60).

Useful Links

Missions

- Spiritual guidance

- Religious Education

- Community Support

values

- Faith

- AL IHSAN

- AT TAQWA

- AS SABR

Contact

- 764220906

- khalifdeslayenes7@gmail.com